Stock exchanges operate as simple two-sided platforms, matching buyers and sellers. Like other platforms, they benefit from network effects. The more people that transact, the greater the value of the platform to others. As traders say, “liquidity begets liquidity”.

US stock exchange markets started their bloom back in the mid-20th century, where they are countless regional stock exchanges, some specialized (i.e. commodities, futures, telecommunication vertical focused etc.) and some generalized (industry vertical agnostic).

But over the coming decades, around the 1980’s to 1990’s, the industry went through a massive M&A consolidation which in essence gave birth to two major giants, NYSE and NASDAQ. These stock exchange operators continue to maintain their market dominance into the mid- 2000’s with solid network effects, economies of scale (more trading >> leverage to compress margin >> either forces competitions out/M&A or unit economics too unprofitable for new entrants), proprietary technology, branding, and government license.

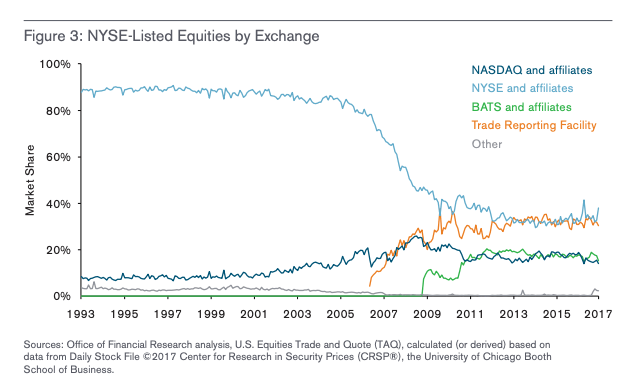

Large established banks have try to bypass NYSE (owned by $ICE, Intercontinental Exchange) and NASDAQ ($NDAQ) by facilitating trade between their clients and counterparties within their own partnership and ecosystem but ultimately, these stock exchange operators still enjoy the benefits of the regulatory guidance and support until 2005 in which the US Securities and Exchange Commission (SEC) Regulation NMS (National Market System), it required every exchange to route order flow to all other exchanges in order to find the best price for customers. Stocks would still be listed on NASDAQ and NYSE but order matching will have to be listed across all the exchanges, to allow customers and clients to get the ‘best’ price possible for that order. It’s a well-intentioned move by the SEC to allow more transparency and fairer price discovery process.

This dramatically changed the cards of the game.

Competition started blooming up and at the peak, there are more than 50+ exchanges (what more or less ended with a duopolistic market pre-2005, pre Regulation NMS is now a multiplayer market.

But there’s more to the story…since 2005 (now in 2021) ICE (parent co of NYSE) and NASDAQ have went on a massive M&A spree in Europe and Asia, buying up exchanges in other parts of the world to re-cement their dominance and protect their margin.

Digital Securities and Alternative Trading Systems (ATS)

We are in Year 2021 – digital securities are just starting to bloom, like NASDAQ/NYSE in the 1980’s and 1990’s, the % of investors who have heard of digital securities is growing and while exposure is still relatively low in comparison to other established and growing asset classes, the % is growing regardless.

I believe we are in the early infancy of the digital securities ATS space now in which almost every companies is in the process or launching (today is Q4 2021) their own ATS, whether it be Securitize, Figure Technologies, Oasis Pro Markets, tZero, Rialto, Zanbato, Texture Capital, OpenFinance and more. US SEC maintains a list of Alternative Trading System (“ATS”).

There is a tune of 30-50+ soon-to-launch/launched alternative trading systems out there today mostly for digital security assets but not one or two have dominance in the market, dominance as defined by liquidity and order volume. This is similar to what the public market stock exchange operators went through over the past 1/2 century – massive boom of exchanges created in the market >> consolidation to duopoly market >> new regulation introduces a few more competitions to the market.

As the digital securities and ATS market grow in terms of # of companies, investor demand (capital inflow) and # investor participants, SEC might introduce something similar to the Regulation NMS (National Market System) for ATS’s for better price discovery and depth of liquidity, which is perhaps, particular important for markets design specifically to trade (and facilitate price discovery) of private assets. Private assets by default is more illiquid b/c it changes hands less often and more often just between a few small market/asset participants = more volatility in price discovery. I am optimistic about market in general because private asset class is still left highly untapped by non-institutional investors but at the same time, it’s also several magnitude bigger than the public market (in terms of valuations of all the assets in those respective public markets and private markets).

The introduction of NMS for private assets trading on ATS’ would ben an optimal environment where API first companies will thrive in (or existing ATS platforms creating API-first products to channel order flow to other ATS like what happened to the public market when NMS was introduced in 2005).

It’s worth noting, one major difference between the public market (which is still more or less dominated by the duopoly) vs private market (for this purposes, alternative trading system (ATS) will be defined as the stock exchanges for private assets) is the # of players out there. I think there is room for many ATS’s to thrive in which is similar to the current stock brokerage market (there’s Fidelity, Schwab, RH, Wealthfront and countless more) as brands play somewhat of an important role for private assets (or at least way more than on the exchange level – like as an individual investors yourself, you could probably care less about whether the stock I just acquired or sold is trading on NYSE or NASDAQ).

Building further on this premise, it also means that these private asset stock exchanges and alternative trading systems cannot operate the same revenue and business model like that of NASDAQ and NYSE in which they charge for inflow order routing (i.e. NYSE and NASDAQ charge other exchanges xx basis points bps to route and fulfill order on their exchanges) which further presents a solid opportunity for API-first companies to create products to route orders between these alternative trading systems. I would be interested to see which companies can emerge in this space from this front and those that can create a product in this order routing space for private securities will capture market dominance.

As Thiel puts it “Monopoly is…not a pathology or an exception. Monopoly is the condition of every successful business.”