TBD, a subsidiary of Square, released v0.1 of their decentralized exchange (DEX) liquidity protocol on Github for public debate on November 19th, 2021. Some background summary here is that Square has been pushing crypto and now DEX to their 40 million+ users on Cash App (Square product). In a more recent interview, Jack Dorsey noted that building products and experiences for users to onramp into the blockchain and cryptocurrency world with bitcoin and other cryptocurrencies is the priority and less emphasis is placed in NFT as of now.

Back to v0.1 of TBD’s DEX – DEX is in essence a decentralized exchange where market participants can trade between each other, without the need to have intermediaries and market makers. The main reason why between and intermediaries are italicized is b/c within DEX, there are also different ways to manage the transaction straight between different market participants. This is a more efficiency approach than centralized exchanges (like NASDAQ, NYSE, CBOE etc.) b/c it does not need a market makers (i.e. Citadel) to match and settle trades between the market participants (i.e. individual and institutional investors like you and I) and make margin on the spread b/w the ask and bid price.

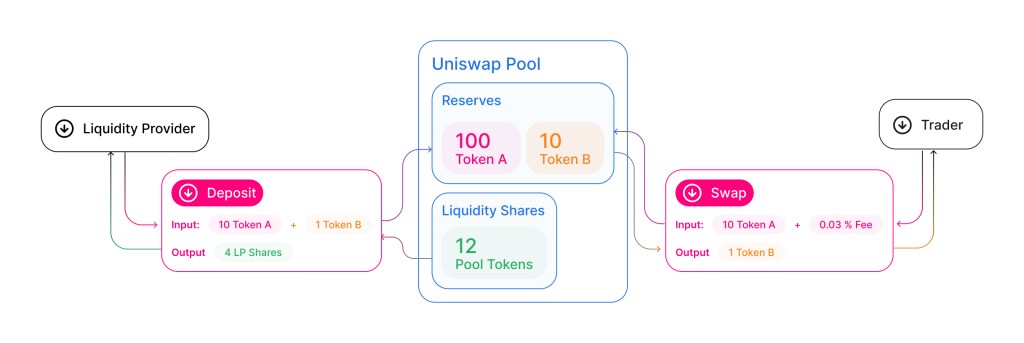

One of the more popular DEX is Uniswap where they basically facilitate transaction/swap between the seller and buyer via liquidity pool. Liquidity pool is in essence a pool of capital where investors can stake/deposit their assets to earn some interest (based on a formulaic transaction) and in exchange market participants on the swap end can tap in here to transact.

Below is a sample of the Uniswap liquidity pools. Second to that is in essence how the DEX transaction happen.

Liquidity pools are on the secondary level, transaction between the different market participants but not truly decentralized on the primary level where market participants can transact directly with one another.

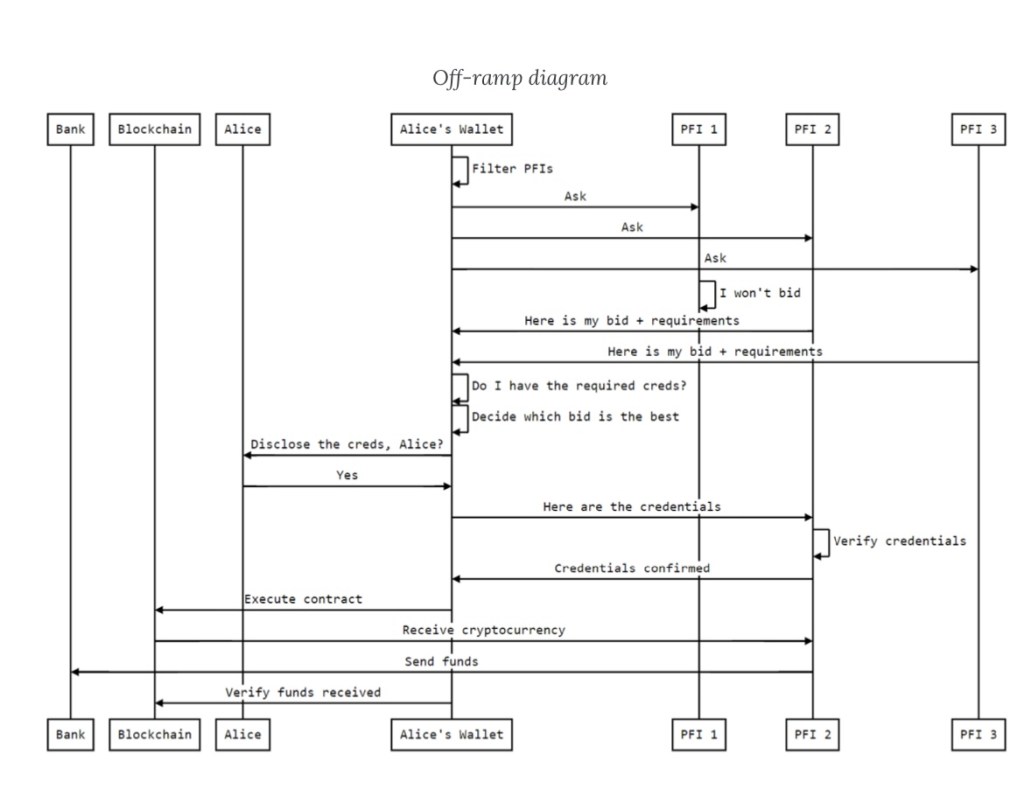

This is where TBD/Square’s tbDEX: A Liquidity Protocol v0.1 comes in. TbDEX puts heavier emphasis on transaction directly between different market participants with credential risk and exposure level as the main transactional cost lever. Credential management for the market participants is heavily emphasized on this v0.1 model. Furthermore, verification of credentials (including KYC/AML and other credential data of the end users) happens on a per trade or transaction level, not just on the per wallet or initial account creation level, which is what most CEX and ATS (alternative trading system) does and maybe spot/randomized checks of credentials across their investor user accounts long-term).

“Transaction costs are ultimately driven by risk. At maximum anonymity, transaction costs will necessarily be higher; at maximum disclosure, they should be lower.”

Transaction can either happen between individual investors of Participant Financial Institutions (PFIs). PFIs can be, but are not limited to, fintech companies, regional banks, large institutional banks, or other financial institutions; PFIs have access to fiat payment systems and the ability to facilitate fiat payments in exchange for tokenized cryptocurrency assets or vice versa..

Furthermore, credential management and trust on the investors can happen “mutually and voluntarily rely on trusted third-parties to vouch for the counterparty“

Some areas of visibility would be appreciated is the calculation behind the transaction cost and the settlement process.

The current process seems like a relatively binary outcome here if transaction cost is heavily driven by the level of transparency of credentials. The on-ramp and off-ramp functionality along with the ability to onboard investors with varying degree of credential transparency it’s a smart way to bridge demand from the current decentralized exchanges (aka allowing max anonymity) but also provide a good ramp into the on-rails of current/traditional financial systems.

Also, more clarity of the settlement and default risks would be appreciated, especially when you have market participants like PFIs (with wide ranging types of of settlement and escrow process and timeframe) and individual participants and the different type of cryptocurrencies with different settlement time seems like confusion between all these market participants is ensured unless the system can and show cap the type of currencies to start initially.

Finally, it’s worth noting that “tbDEX protocol aims to utilize systems of decentralized identity with VCs to create markets of trust, through mutually chosen third-parties. This may be perceived as seeking to undermine anonymity or “deanonymize” transactions. But we must also recognize that for the aforementioned reasons, anonymity for transactions of goods and services comes with a cost: unbounded counterparty risk.“

The goal is not to maintain anonymity of transactions at all costs. Nor is it to undermine an individual’s ability to optimize for anonymity. Nothing in principle precludes anonymous transactions for financial privacy on the tbDEX network. A PFI could, in principle, require no VCs, but such transactions would represent a high degree of risk to the counterparties.