Today, the Federal Reserve proposes easing regulatory framework for foreign banks in the US (but it lacks liquidity framework for foreign banks with domestic presence – which holds multi trillion of assets as of YE2018.

Relaxing banking regulation is a fine double-edged sword – for one, it opens up the # of transactions and credit lending between banks and relatively more efficient productivity output but on the flip side, the essence of Austrian economics’ “creative destruction” and “greed” takes over.

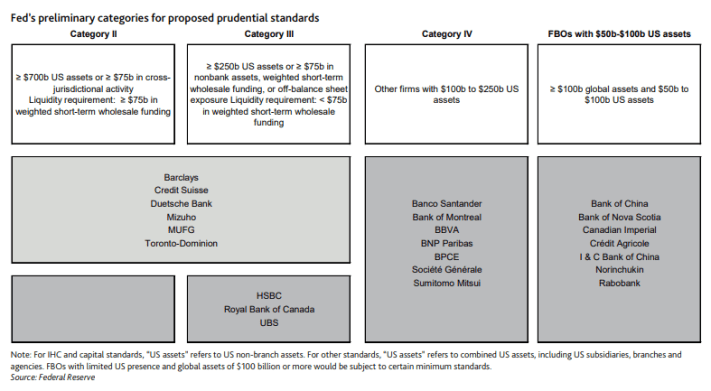

On 8 April, the Fed proposed revisions to its standards for the supervision of the US ops of foreign banks (referred to as foreign banking organizations) based on their US risk profiles. The proposal would apply less rigorous capital and liquidity standards to many FBO intermediate holding companies (IHCs). Furthermore, DOMESTIC banks in the 4th-tier below are now only subject to 70-85% of the full reporting and capital buffer requirements noted before.

At the same time, they also proposed reduced frequency and stringency for required resolution submissions, in some cases, extending the intervals between bank bankruptcy resolutions to SEVERAL years, for large domestic and foreign banking firms, which could drastically prolonging misallocation of credit and asset in our system.