Thiel just announced the relocation of one of his many investment vehicles to the hopefully upcoming tech talent town of Austin, Texas. And digging deeper into his history of investing and building, not only is he only for his involvement in PayPal, Airbnb, LinkedIn, and Facebook, all of which are generational-defining startup of their own decades…but he was also an investor in Zynga.

Zygna taught us the danger of having 95% of the revenue source (Happy Farm) coming from its heavy reliance on Facebook alone, but on the flip side, they also taught us building some form of independence, in which you allow some form of independent decision-making, in your own ecosystem is one of the ways to build real longevity and moat into your product for the years to come i.e. Slack Investment Fund or FB Messenger product group have great independence as evident in the speed of product feature launches and David Marcus leading it)

He was in fact, a fan of Girard, a French philosopher with a great masterpiece called, “Things Hidden Since The Foundation of the World” He goes on to explains how an esoteric philosophy book shaped his worldview

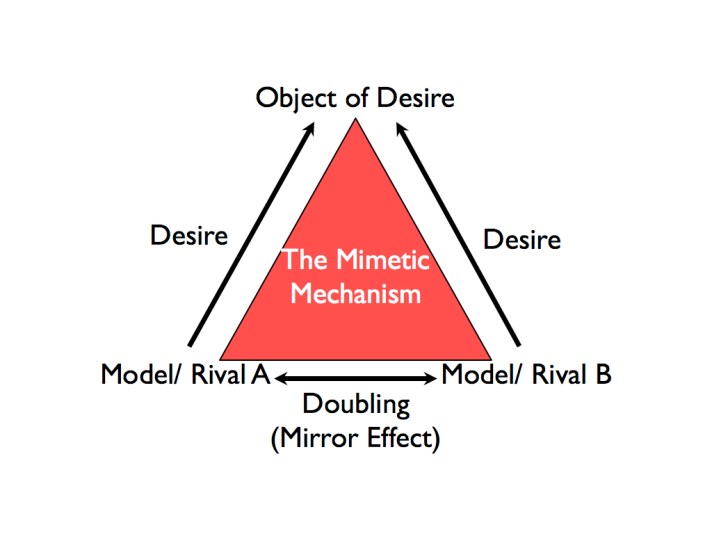

Girard’s main concept is “mimetic theory,” which states that most of human behavior is based upon imitation. The imitation of desires leads to conflict, and when a buildup of conflict threatens to destroy all involved, they use a scapegoat to return to balance. Much of Girard’s work delves into Christian theology, which has also had a profound effect on him as well.

Simplest of all is the idea that imitation is at the root of all behavior. According to Girard, imitation is inescapable. As a rule, we do what we do just because other people are doing it, too. That’s why we end up competing for the same things: the same schools, the same jobs, the same markets. Economics will tell you that competition dilutes profits, and that’s one big reason to question it.

Girard gives at least two more reasons: (1) competitors tend to become obsessed with their rivals at the expense of their substantive goals, and because of that (2) the intensity of competition doesn’t tell you anything about underlying value. People will compete fiercely for things that don’t matter, and once they’re fighting they’ll fight harder and harder. You might not be able to escape imitation entirely, but if you’re sensitive to the way it drives us then you’re already ahead of most.

AND to quote Jeff Bezos’ latest speech he was at Washington DC Economic Club just two weeks ago from today….

“It takes your competitors on average 12-18 months to imitate everything you so-called “create”, so the only way to stay relevant in the long-term is to build constant medium-term iteration into the product and business building process.”

Bezos cited how Google and Apple launched their own respective speaker exactly 12 month after Amazon launched Alexa speaker and so forth AND vice versa, the flopped Amazon Fire Phone was launched a few months later when Facebook launched their flop Facebook Phone with HTC (bet most cannot remember Facebook and/or Amazon actually launched their own branded smartphone). Hence he is known for anointing the the concept of making it always “Day 1” in your business.

The 12-18 month iteration goes both ways – from your competitor to you and vice versa, which has profound implications on medium-term planning and product launches.

He is, indeed, one peculiar and thought-provoking builder and startup investor.