Earnings season is right upon us once again. Back in Nov 2017, I wrote about the an line item we should review from these systematically important bank’s earning, the credit loss provisions. After all, we have fully shifted to a credit-based economy in which US consumer credit-based spending now consist of 70%+ of our annual GDP.

I went ahead and quickly pull together the credit loss provisions from JPM (largest derivative books in the trillions) and Wells Fargo (largest residential and commercial mortgage servicer in the US) and both happened to report this past Friday. I would say credit loss provisions (CLP) provide a directional guide in how management team assess the risks and delinquency associated with future revenue and liabilities. Don’t get me wrong, revenue, profit and EPS are important, but these can be financially engineered through expense recognition lag, equity buyback etc. Think of CLPs as a cash reserve pool in which it can be readily ‘deployed’ in the case of clients delinquent on their credit/loan. Directionally speaking, the higher the CLPs on a YoY basis relative to credit/loan growth usually indicates growing risk on the loan/assets on the bank’s book.

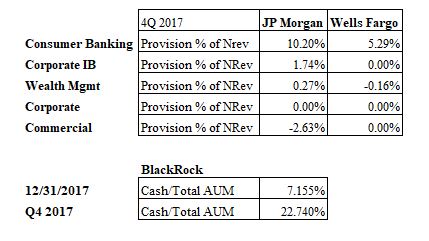

I have broken down the credit loss provisions by different verticals within these banks and as you can tell, consumer banking/credit card has the highest provision as a % of current quarter’s net revenue, which makes logical sense given the sub-2% US consumer savings rate, and the 3%+ in credit > the sub 1.5% growth in income (aka consumers are using debt to fuel their lifestyle). Also, since BlackRock, the largest asset manager in the world sitting at $5.5 trillion, also reported, I thought it might be interested to see where these institutional investors are placing their bets.