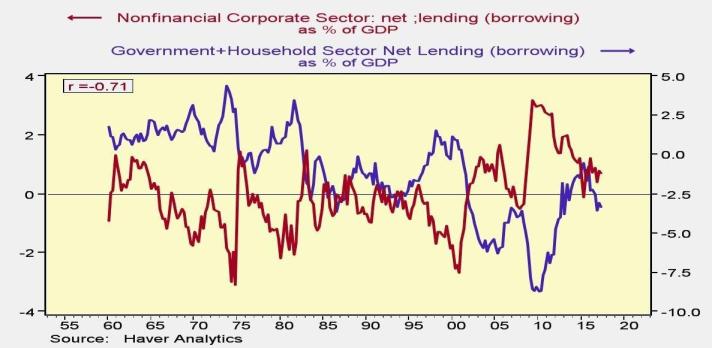

If you want to understand government deficits, you need to see the sea change in business behavior since 2000. Business sector has gone from being a net borrower to being a net lender (meaning capex less than cash flow), which also coincides with corporations engaging in these so called EPS “financing engineering”, most of which has been facilitated with debt not cash flow. R&D is and will continue to be the leading driver of our country’s future competitiveness, not EPS (which has side contributed to the ever growth wealth disparity).

A prime example of this is Restoration Hardware, in which they bought back 49.60% of the floating shares within just a 2-quarter period, which essentially means if earnings declines by 50%, EPS will remain the same as that of last quarter’s. Don’t get me wrong, I enjoy their newly upgraded French Chateau-style store interior and exterior as a customer, but 49.6% sounds a bit extreme and the juicy part, pretty much all of it is financed with debt (apparently market is loving this for now).