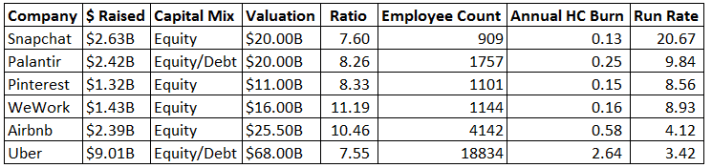

Marketwatch FB bot sent me a message this morning regarding Snapchat raising an additional $1.81B at a valuation of $20B, propelling the company to the ultra-unicorn elite club, which include members like Airbnb, Uber and Palantir. I decided to do a quick simple analysis on where this funding stand among the members of the club. Per the analysis below, ratio of valuation/$ raised sits comfortably at 8-11. This is relatively on par with the public market P/E ratio of a stable income-growth company. The historical overall market P/E ratio hovers about 8-9. Bear in mind the ratio for these private companies is difficult to capture given some $ raised are done via debt offerings. Snapchat has one of the lowest valuation/$ raised. I believe WeWork has a higher ratio given that they kind of operate like a real estate investment trust (REIT), which typically has a higher P/E ratio on the public market given the predictability and stability of their income stream.

The majority of these companies have headcount as the highest burn rate on an annual basis so I started my analysis from here. I assumed $140k cost per head, including salary, benefits, perks, office supplies, and rent (all in an individualized basis). Per # of headcount on LinkedIn, Snapchat has the lowest number of HC within the ultra-unicorn elite club. This is actually a very good scenario to be in, given that they have a lot of capital left to be deployed for R&D purposes.

While Snapchat grabbed the headline this morning about “crazy” valuation, I believe that are given their relatively low employee count, low annual headcount burn rate and “P/E” ratio, I believe they are poised to put this $ capital raised to good use.

Data Source: AngelList, Crunchbase and LinkedIn.

Below is public interest of the company via Google Trends. Obviously different companies have different ways of interacting with users and customers so Google Trend might not be able to capture those audiences in other verticals of interactions (like apps (Uber/Snapchat) or consulting (Palantir).