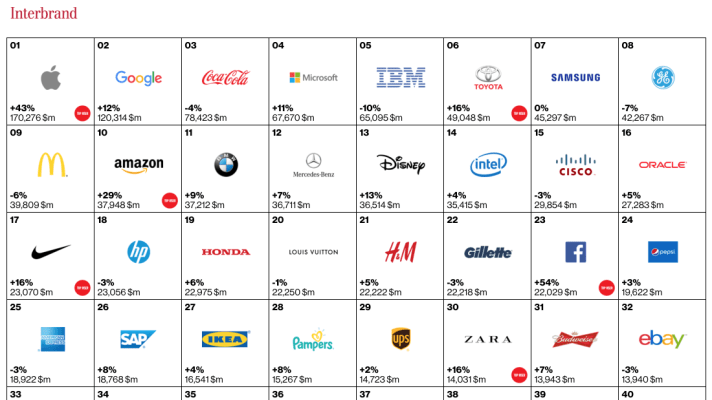

I recently saw a list of the Y-Y brand valuation growth for the top global companies on LinkedIn and thought it might be interesting to see the relationship of brand valuation growth and their stock equity price growth. Having followed the equity market on a daily basis, my first sight tells me that brands with negative Y-Y growth usually tends to have plateaued or negative revenue and/or profit growth. For example, Google and Apple has been competing face-to-face in 2015 for the US most valuable publicly traded company, from the market capitalization perspective. My first instinct also tells me that consumer (CPG) brands will have an easier time making the list as their products resonate with the general consumers. However, seeing enterprise-oriented brands like IBM, SAP, Oracle and Cisco on the list proves me wrong.

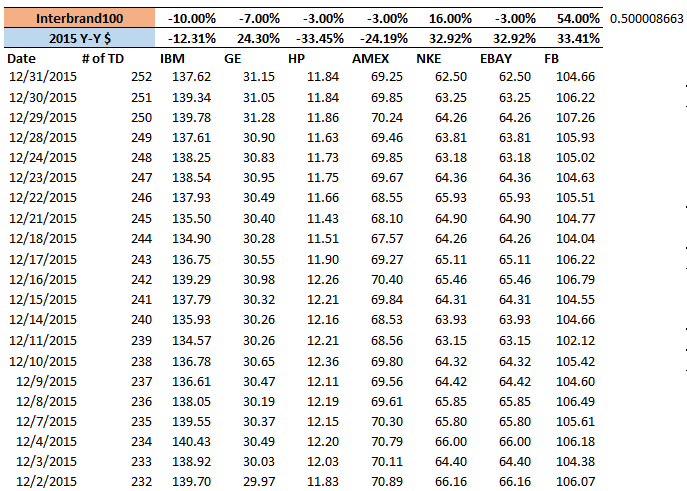

Back to the quick analysis, I compare Y-Y stock price change of the respective companies. Note that I did not do all the companies are there were too many. In blue line, you will see the Y-Y stock price change of the respective company and in orange, you will see the Y-Y change in brand value. The correlation between the two data set is just a mere 50%. I notice one downside to my analysis is that investors usually conduct “tax harvesting” at the end of every year, thus using the last day of the year as one of the variables is flawed. Secondly, the data set I use is on a daily metrics while Interbrand 100 is based on just two days of the Y-Y comparison (meaning the valuation in between the first day of the month and when they collected the data is void).

I chose the following companies based on some on the major information I acquired about throughout 2015.

IBM: The company went through 15+ quarters of revenue decline. While their revenue and profit remains plateaued, their free cash-flow (FCF) remains relatively solid. The company has yet to cut their dividend payment (unlike the major energy companies).

GE: I believe GE is one of those too-big-to-fail companies, at least back a few years ago, given the # of jobs they provided and the long and wide verticals and horizontals on the industries. GE went through several major metamorphosis this year from selling their appliance unit to Chinese investors and GE Capital (one of the top 10 capital banks in the country) to major institutional banks. By the way, GE Capital also offers one of the highest Certificate of Deposit rate out there last time I checked.

HP: HP is a very interesting company as it has tried numerous times to venture into mobile and the slowing PC market added an extra pain point for the company. The company finally decided to break into two companies, one called the HP Enterprise, which focuses on Enterprise applications and the other called HP, which focuses on more consumer-oriented products.

AMEX: Costco, one of the largest retail shops in the world by revenue (100B+ in annual revenue), recently cut their long historical ties with AMEX, citing their new collaboration with MasterCard and VISA. Another major US hotel chain also cut their ties with the company following the footsteps of Costco. From my perspective and as well as from chatting with my friends, AMEX service fee charges is way higher than the competitors and their point-reward system is not as promising as their use to be (this use to be their selling points back a few years). I find it kind of funny how even a ramen shop around the corner also declines to accept AMEX CC. This goes on to show the importance of maintaining and safeguarding one’s value proposition.

NKE: Nike is one of those behemoth that is still able to maintain 20-30% Y-Y growth rate given that APAC region returned handsomely in 2015. Under Armour is pretty much the only competitor out there from the basketball industry perspective. Nike recently signed a lifetime deal with Lebron James, trying to create the next billion-dollar brand like Jordan brand. Under Armour, aka one of their only competitors in the sports, and more specifically the basketball industry, also signed a major deal with Steph Curry, the new and upcoming MVP and star player.

FB: I chose FB given their impressive earnings releases a few weeks ago. FANG (Facebook, Amazon, Netflix and Google) all delivered a mouth-drooling return in 2015. But only Facebook continued to impress the market with their earnings. Amazon delivered amazing yearly revenue (100B+ annual rev and huge profit margin from AWS) but their delivered fail to beat the estimates (some were projecting a weak shopping season due whether due to macro-economic variables or market saturation still remains a question). Netflix will increase their capital expenditure (CAPEX) dramatically given their global launch in 100+ countries as well as increasing their in-house production titles. Google beat the top-line estimate for revenue and EPS and on-track to deliver more as they start to monetize YouTube, with products like YouTube Red.

This year has been a rough start to the whole equity and funding market, thus doing a similar analysis next year will provide less effective. Itt would definitely be interesting to see who will come out to the top in next year’s Interbrand 100? Will consumer brands dominate the overwhelming majority of the chart or will it be somewhat similar to that of this year’s?

Feel free to leave me a comment of what you think.