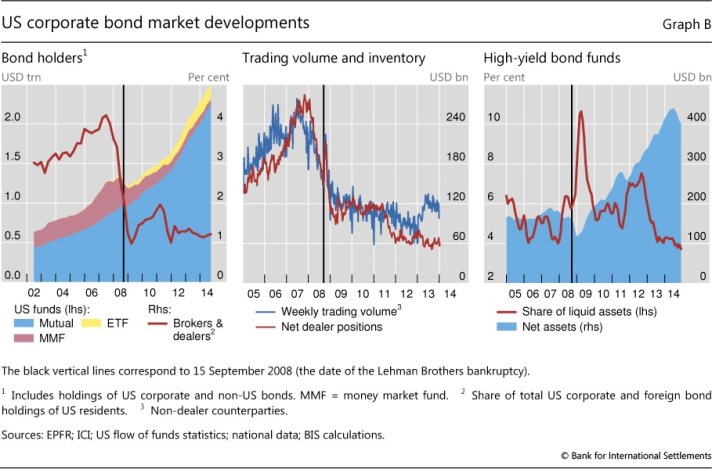

High-yield bonds have been on the rise since the Great Recession as investors chase return without focusing too much on the risk. High-yield bond funds have a high % of energy companies, thus, with the recent precipitous fall of oil price, the impact can be felt hard. A few downstream and upstream energy companies have recently faced insolvency and declared bankruptcy. Falling oil price contributes not only to declining revenue but also makes the company unable to fulfill their debt obligation. Liquidity risk indeed presents a clear and present danger now for the majority high-yield bond fund. The move, announced this past week by Third Avenue Management funds, was a troubling sign that recent deterioration of the HY bond market is only the beginning. Third Avenue’s Focused Credit Fund, which not long ago was about $2.5 billion in size and had recently shrunk to $788 million as investors rushed to redeem their shares because of weakness in the junk bond market.

There are several mechanisms to manage liquidity risk during adverse market conditions:

1) Sell liquid assets to meet redemption – for example, if a firm faces redemption amid a Eurozone crisis, the firm would opt to hold onto its periphery European sovereign bonds (market condition simply cannot support any material selling without blowing through support levels). Instead, they would sell liquid high quality corporate names and agency debentures or sell assets that are neutral to the on-going market volatility

2) Replace nominal cash positions with synthetic securities. This would be selling nominal Treasuries and Bunds to go long in their equivalents in the futures market. Similarly, investors can replace nominal cash interest rate positions with swaps. Both would free up balance sheet to meet redemption, without decreasing risk exposure in the rates sector (there will be additional risk exposures, such as basis between synthetic securities and cash bonds, but it is a small price to pay). Moreover, this allows the firm to keep their illiquid positions intact, so they can be sold at a controlled pace.

3) Use cash. Most mutual fund managers have a percentage of their assets in cash – this cash comes from many sources – amortizing mortgage backed securities (paid off loans as a result of refinance will manifest as lump-sum cash to investors), interest payments from bonds, or dividend from stocks.

Post-crisis asset markets are less liquid, partly due to heightened financial regulations, and partly due to bond funds having more asset under management. Thus, a rush toward the exit in today’s environment would present a significant risk to investors, even if there are proven measures to manage such risk. My take is that the precipitous fall of high-yield bond market is only the first domino, the whole bond market (some countries are still running with negative-yield bond rate) will go through a significant change in the coming months.