I was listening to the Bloomberg podcast on my drive to work this morning and some economists and analysts were quoting a 45% chance of recession in 2016 and one of the major banks quoted a 76% of recession in the coming year or two. The global economy and equity market has been fattened with low-interest environment in the past years as borrowing cost was at all-time low and investments have been reallocated to the equity and corporate bond market to chase return. The latest policy speech by Federal Reserve officials indicated that a broad range of FOMC participants are prepared to raise rates at the December meeting, though the readiness to act will still be subject to changing economic conditions both at home and abroad. The global economy has been able to grow and stay afloat in the past few years due to the various QE measures implemented by major monetary systems. However, the following incoming risk factors may still derail the likelihood of increasing the federal fund rate in the December meeting:

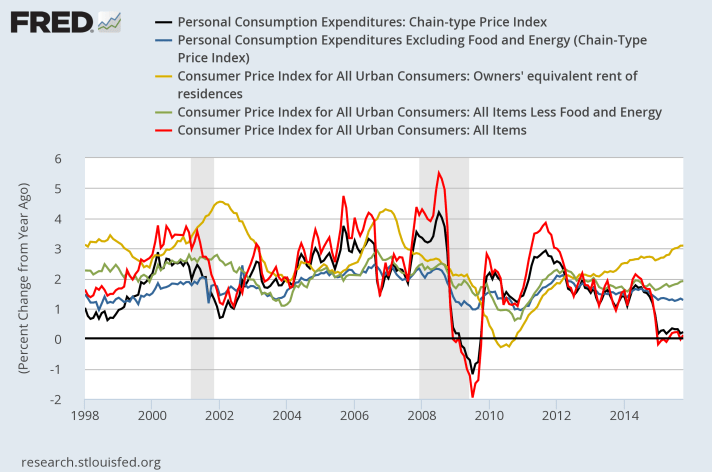

1) The BLS will also release the November CPI on the day of the FOMC meeting (Dec 15th) – officials will have the latest realized inflation data in their decision making. The officials have been trying to target for 2% inflation rate in the past few meetings.

2) Another significant decline in energy prices, which would “push out” the path of overall inflation returning to FED’s 2% objective, measured in Personal Consumption Expenditures. As of today, the WTI has dropped to below $40/barrel.

3) Foreign economic risk factors include a further signs of weakness in China or indication that the People’s Bank of China is unwilling to offset the aforementioned weakness with further easing. But as of this morning, report has shown that the People’s Bank of China (PBOC) has shown a record decline in foreign reserve, signaling a selloff of foreign currency (mostly USD) to offset the depreciation of Chinese RMB. Further signs of European economic weakness are another potential foreign risk. The European market had a brief selloff a few days ago due to the high market expectations for Draghi’s flat asset-buying program.

Finally, recent FED speeches were released with a purpose of setting market expectations. The FOMC does not like to surprise the market on concerns that undesirable market volatility may changes the level of funding cost to unintentionally constrains economic activities. A December rate hike is currently 76% priced in, and some FED officials may think twice if this probability drops below 50%. A hike is definitely coming so brace for the headwind, even the Volatility Index (ticker symbol: VIX) has ticked slightly upward (though it was minimal compare to the Greek “crisis” earlier this year).