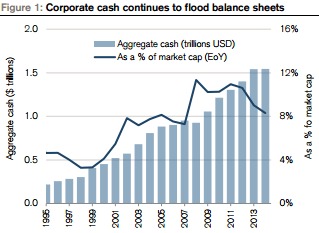

Over the past 20 years, the amount of cash on US large cap companies balance sheet have grown almost 7x, sitting @ a current value of $1.7 trillion USD, or 8% of total US market capitalization. After the massive ’08 meltdown, companies are holding a more cautious hand in reinvesting that extra cash into improving and enhancing company operations and efficiency. Below is a map-out of the aggregate cash (trillion USD) as a % of total US market capitalization (credit to Credit Suisse for providing the graph below). The aggregate cash is generally upward trending, despite the small dip in 08/09. One interesting phenomenon one can derive from the graph below is the massive decline of aggregate cash as a % of total market cap in the 2013-2015 time frame.

I believe there are two major reasons for this decline. Let’s tackle the denominator and numerator separately. The first reason is the market capitalization growth outpaced the increase in aggregate cash growth. As a friendly reminder, market capitalization is the total # of outstanding shares x current share price. To dive deeper into this, there are two reasons for the increase in market capitalization. First is that the Fed’s QE had pressured the interest rate to near-zero, therefore forcing investors to chase return on the public equity market (potential bidding up the price). Second, companies have been releasing more new equity offerings to the market (as a way of raising more cash to fuel investments and/or keep it on the balance sheet), therefore increasing the # of shares outstanding. Even if investors are investing @ the same price since 2011/2012, more outstanding shares will, in theory, increase the market capitalization.

IMPLICATIONS

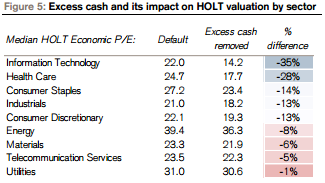

Stacking piles and piles of cash away in the balance sheet can potentially create negative impact on the company’s operating metrics and valuations. Negative impact on the operating metrics is mainly due to the fact that growth in corporate cash is currently outpacing investment in productive assets such as land, inventory, R&D and PP&E. Secondly, excess cash can drastically impact the valuation of the industry and company. For example, IT and Healthcare sector have the greatest impact on economic P/E valuation once excess cash is removed. Utilities and Telecom sector have the least impact on economic P/E valuation once excess cash is removed. The simple, straight line explanation is that IT and Healthcare are high-margin industries, therefore providing the ability to create stockpile of excess cash. On the other hand, utilities and Telecom sectors generally have very stable and minimal growth, therefore limiting their ability to churn out excess cash.

Our current market condition is characterized by elevated valuation, low valuation dispersion, limited growth prospect and opportunity, and limited global growth, thus choosing your sector and companies will require more thinking and analysis.