One of the biggest winners in the market over the past twelve months is chip maker Ambarella ($AMBA). The company that provides high definition chips and supports names like GoPro ($GPRO) has shown explosive revenue and earnings growth. The company was everyone’s radar after GoPro’s IPO. AMBA delivered an impressive 1800% run since it went public back in Oct 2012. Moreover, the price has appreciated about 32% since June 2nd (just about 2 weeks ago from this post) earnings release. However, short-seller Citron Research reported that AMBA will follow the path of 3D printing stocks. I have personally been following 3D printing stocks for about two years and most of the major companies, including the likes of 3D Systems and Stratasys, have experienced a 70-80% decline from their all-time high just has year.

The main points in Citron Research analysis include Ambarella’s markets are all “niche plays,” questions on how many customers will upgrade 1080p hardware for 4K hardware (requires more powerful SoCs), and argues Ambarella’s product line (competes against SoCs from Sony and Taiwanese firms) will “become increasingly commoditized” outside of the high-end. Ambarella has argued its algorithms, power consumption edge, and video data/analytics investments set it apart.

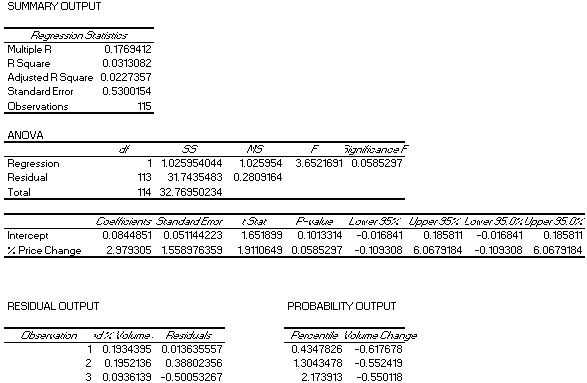

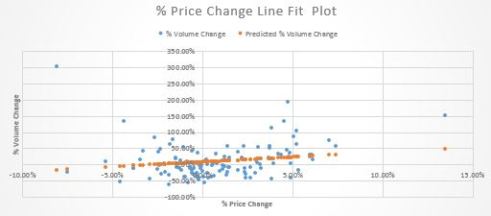

Today, June 19th, the day Citron released their analysis, AMBA stock got hammered by ~6%. A large portion of this drop is definitely attributed to Citron’s short-selling report, however, I noticed the increase in trading volume has been rather slow so I dig deeper into this by conducting a regression analysis between the % change in share price vs. % change in volume. I mapped the data using excel. The correlation between % in share price appreciation/depreciation and % in daily trading volume change is only a mere 17%, suggesting a weak relationship between the two. Moreover, the relationship between these two variables only has a R-squared or coefficient of determination of 3.13%, suggesting that the variables are too far-fitted to the regression. The standard error of means sits at ~53%, implying that our sample data is 53% sure that it’s a true representation of the population. The discrepancy can be attributed to the the exposure this niche industry has been getting since Fitbit, GoPro and Apple all came out with some sort of so-called wearable technologies.

While AMBA has delivered above-average expected return from the EPS and earnings Q-Q and Y-Y perspective in the past 6 quarters, the company has had a great run since last earnings release. Citron cited that AMBA is comparable to DDD and SSYS, but AMBA does not currently hold any long-term debt and the growth has been fueled by the overall industry growth (whereas 3D Systems and Stratasys have been fueling their revenue and EPS growth through organic means like M&A). The share price has been experiencing downward pressure hovering around $118-119. Today, June 19th, the daily share price has been volatile, trying to break the $120 price point, then back down to $118-119. Moreover, a simple glimpse of the call/put options distribution has suggested a medium price appreciation in the next months or two. Wait a day or two before the trading volume and price depreciation cools down before stepping in as there is a lot of potential for growth in AMBA.