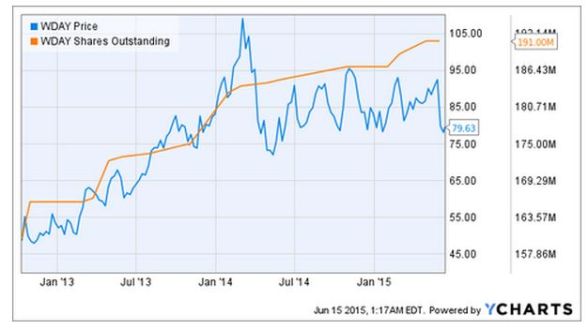

Workday is an enterprise resource planning (ERP) service provider which helps medium to large enterprises alleviate their day-to-day operational burdens. Essentially, Workday provides a central platform of interaction for users of interest. The company had an IPO back 2012, and quite a stellar one. Roughly 23 million shares exchanged hands for about $620 million, the largest tech IPO since FB. Price at the IPO was around $28 and rose to $105 subsequently. It is now at $78. What is more noteworthy is that the stock hasn’t really been affected by the almost 700% increase in shares outstanding. In fact, the company has also offered convertible notes due in 2018 and 2020, both of which will likely impact the shares outstanding.

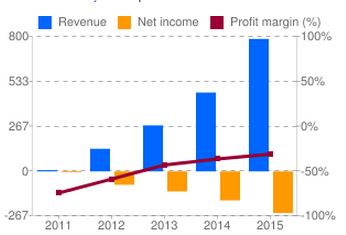

The increase in share outstanding will, in theory, affect the earnings per shares on a Q-Q and Y-Y basis. Workday’s EPS in 2011 was ~ (2.71) and improved to ~sub (1.00) in the previous few quarters. But in reality, the “improvement” had nothing to do with performance. It was more to do with selling equity. If we normalize the earnings to the initial 2011 level, we see that the earnings in 2014 were actually around -$8. Yeah, -$8 per share in earnings. In fact, if you look at their Y-Y financial statement, while revenue has been on an exponential growth, the net income has been growing at an even faster negative rate growth. The chart below is provided by Google Finance.

If we were to map out all the shares outstanding into 2025, we would see an upward trending curve. If everything remains constant, meaning revenue will continue to grow at this fast pace and net income will stabilize, we would see a relatively plateaued or negative EPS growth. If your trading strategy is focused on EPS metrics, then shorting Workday would be a viable route. But bear in mind, I don’t truly know how the SaaS business model that Workday is somewhat utilizing work. If the burn rate starts to slow down in the next few years, then we might see optimism in the EPS. This post is solely my opinion and observation and does not entail any trading strategy recommendation.