Volatility is often denoted as VIX (ticker symbol for Chicago Board Options Exchange Market Volatility Index). VIX measures the implied violability of the S&P500 index. As depicted in the chart below, implied volatility peaked at 2008/2009 Great Recession. Investors and traders alike are less confident in the market.

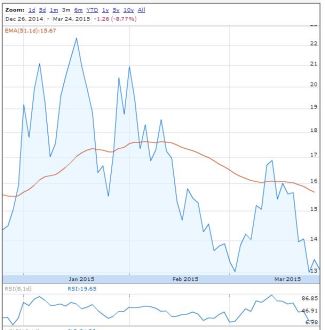

Since Janet Yellen from the Federal Reserve announced on Wednesday, March 18 of a no change in its target Fed Funds interest rate (but with the removal of the word – “patient”), market volatility has been down. The general public is expecting federal fund rate in mid-2015. But this boost of confident from Fed Chairman, Janet Yellen, will/has continue to fuel record-high equity market.

According to the Fed announcement, most of the rate increase will be data-driven (unemployment, inflation rate, comparable economies acceleration/deceleration, strong US dollar dragging the US economy etc.) From several perspectives, the Federal Reserve will definitely hold on the rate increase until next year due to the weak global economy and fragile equity market.