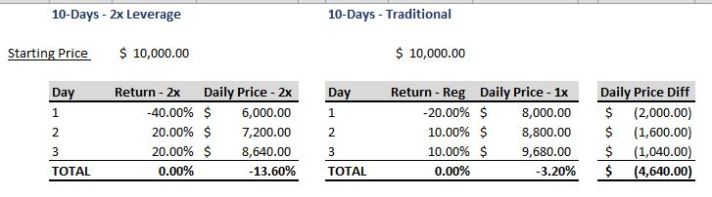

Leveraged ETFs are known for their natural decay. As my previous post emphasized, leveraged ETFs are meant for day trading. As depicted by the chart below, a traditional ETF in a volatile downward trending market will return 0% at the end of Day 3, resulting in a portfolio value of $$9680. However, in a 2x leverage ETF, in the same market environment (meaning same percent increase/decrease in the market at any given day with the same amount of monetary input) will bear a return of 0% as well but with a portfolio value down almost 14% at $8640. This example shows the time decay of leveraged ETFs. It is vital to understand the concept of leveraged financial products as a day trading instrument. While the return in both scenarios bear 0% (market down -20% in day 1, and up 10% in day 2 and day 3) but the portfolio value differs widely. For example, the 10% gain in day 2 is 10% gain from the preceding day (not from your original investment of $10,000). If I am to model this out to a longer time frame, this would result in an even greater possible gain/loss in portfolio value.

- Comment

- Reblog

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.